Angel investing is conviction — based investing. This is why I wrote my check to Rasa before Alex & Alan launched Rasa NLU, an open source natural language processing framework. As we share the news of their traction and seed round here’s a look at four of the bets I was taking then, how things turned out and how it impacts what I am interested in as a startup helper.

1 The cycle – applied conversation AI is early

Perception

For many, at the beginning, Rasa was a “me, too” product. In this view, NLU looked like a simple drop in replacement framework for Wit.ai (FB), Api.ai (GOOG), Watson (IBM), Lex (AMZN) and LUIS (MSFT) that piggy backs on NLP libraries from the great also Berlin-based Spacy or Stanford University. FB had launched its FB Messenger bot platform a couple of months ago and a bot hype was real.

What I thought

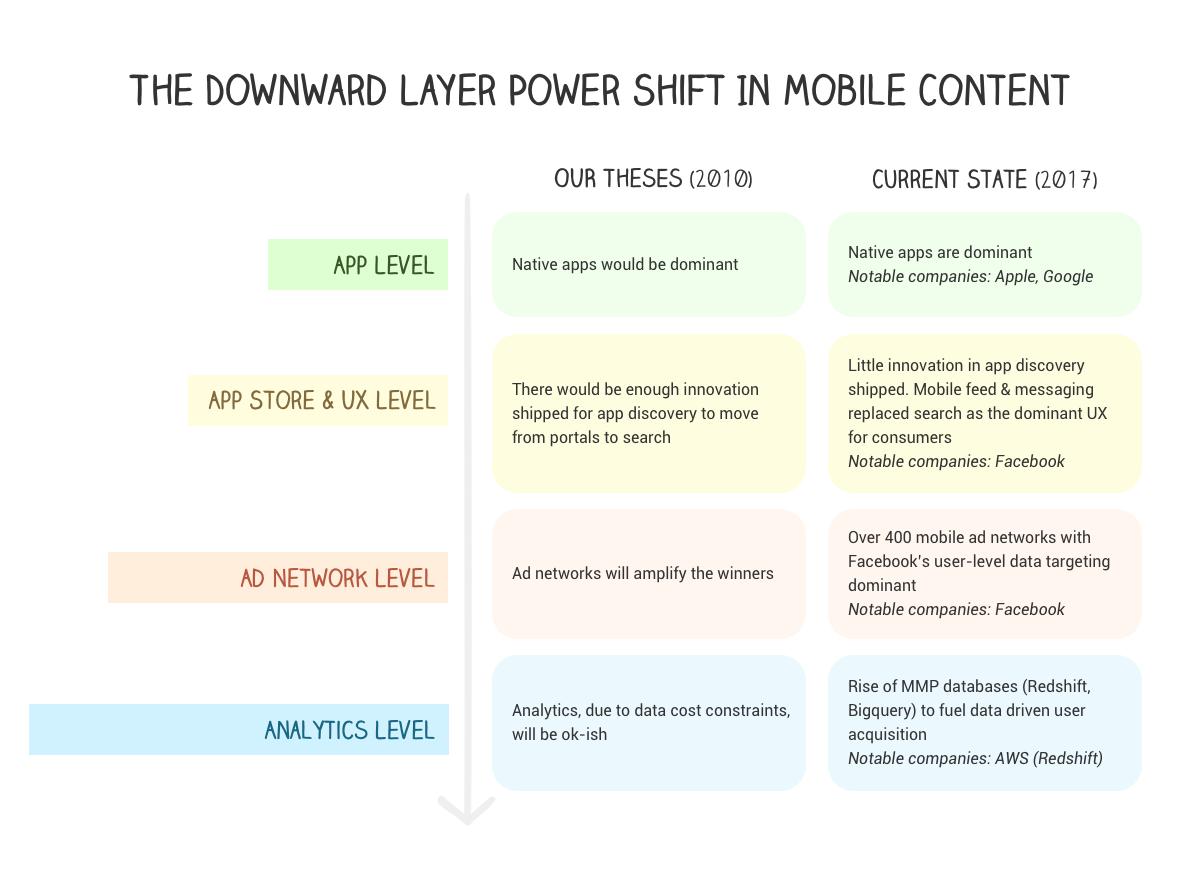

I get a lot of my ideas from looking into what devs I respect are building. Looking into that it was pretty clear that what was being built was very, very simple. It reminded me of the ’06 WAP days in mobile. Most technical startups in the space I was meeting had similar pre-App Store problems.

What happened

There is consensus that early bot hype crashed by early ’17. Facebook reported a failure rate of 70% for its bots which leads to an unacceptable user experience. Facebook engineers will now focus on “training [Messenger] based on a narrower set of cases so users aren’t disappointed by the limitations of automation.”

The main enterprise use case from the first generation of bots is customer support. I have discussed why the early tech was good enough here. The simplified gist of it is that this early tech the platforms pushed to scale is ok in:

- automating the “listening” to (i.e. understand human language, in each node of a decision tree, in very specific contexts)conversations +

- presenting FAQs in answers

There’s +100 vertical customer support startups in the space built on the premise of the early technology. Some of them are pushing beyond. But generally, the tools and the tech is early.

In the words of new Rasa angel Ross Mason of Mulesoft fame:

“Conversational AI today is where the web was in the early 90s. Third-party tools such as Microsoft Frontpage allowed companies to put up simple static web pages quickly.”

Related, I observe that the thesis applied AI is early continues to be true across multiple AI verticals. If you have similar thoughts — such as Anton on Autonomy — drop me a line, I want to meet you.

2 Market demand is high

Perception

At the time NLU launched the bot hype was still happening. At 2017’s Facebook f8 conference, Facebook touted 100,000 bots had been created on the Messenger platform.

What I thought

I was interested in, yet sceptical about the early messenger platform bot hype.

With Rasa, I thought, we were in a slightly different bucket, though. We were not in the 1st generation SaaS API bucket (where Wit.ai (FB), Api.ai (GOOG), Watson (IBM), Lex (AMZN) and LUIS (MSFT) operate)). With Rasa, we decided to go into the on-premise market, targeting a different (enterprise-y) data set and group of clients.

A large chunk of this view that that view was built on my biased pattern recognition.

We were shipping (app search) enterprise APIs with my old startup Xyo ‘12-’14. During that time I learned that platforms have all kinds of biases. For example, while they have a lot of great people within their organisations, they are usually mediocre at best in reading market demand and catering to it. This is particularly true when:

- a big end user behaviour shift is happening (eg in the Xyo case the shift towards touch on small displays)

- when specific vertical types of data sets are involved (most platform people assume “they have all the data”)

This is to say that whenever I see the big platforms I usually think “attack how” and “is it worth it?” while most investors feel fear.

What happened

The market is way bigger than I thought. Rasa’s recent traction, up to 100k downloads from 30k downloads on Github, is an indicator. Some qualitative observations are more important, though.

In Alex’ words: “Above all, the growth is driven by ambitious developers who have hit roadblocks with SaaS APIs for natural language understanding. We’re thrilled to see so many Fortune 500 companies investing early into building out conversational AI like chatbots and assistants in-house. Our traction is illustrative of thousands of companies realising that AI affects the core of their business operations, making it a massive competitive edge in the next decade that you want to own in-house.”

Admittedly, I can say that I had not seen a large chunk of it happening at all. There’s a massive end user behaviour change happening in how enterprise adopts software. Open Source/Github is now a massive distribution channel for Enterprise. The enterprise on-premise market is massive. Back in the Xyo days selling APIs was to enterprise was very, very different. There’s a new company behaviour here and I am very excited about it. If you have thoughts on that or are a startup in this space, ping me, happy to continue to learn.

Again to quote Ross Mason here:

“We are seeing the same patterns play out now, with in-house product teams using Rasa to go beyond the limitations of the first generation of tools. Rasa makes it easy to run AI engines in-house as well as in the cloud, which is a big advantage as most enterprise systems and data are still on-premises.”

3 Competition in applied (conversational) AI is low

Perception

When I talked to some of the (“deep tech”) VCs back then pretty much all of them assumed that the AI space is crowded, moats are needed to compete even in the short-term and that in this day and age the platforms are eating the largest chunks of the cake anyway, particularly now in data-heavy AI.

If they looked deeper into our specific space, then a typical direct competitor chart for Rasa showed the platform and +-60 startup competitors, not counting indirect ones. Given that there’s some serious VC money being dumped into AI, it’s supposed to be a golden competitive age of vertical AI startups

What I thought

AI looks competitive and definitely is competitive — in specific data types and in specific niches.

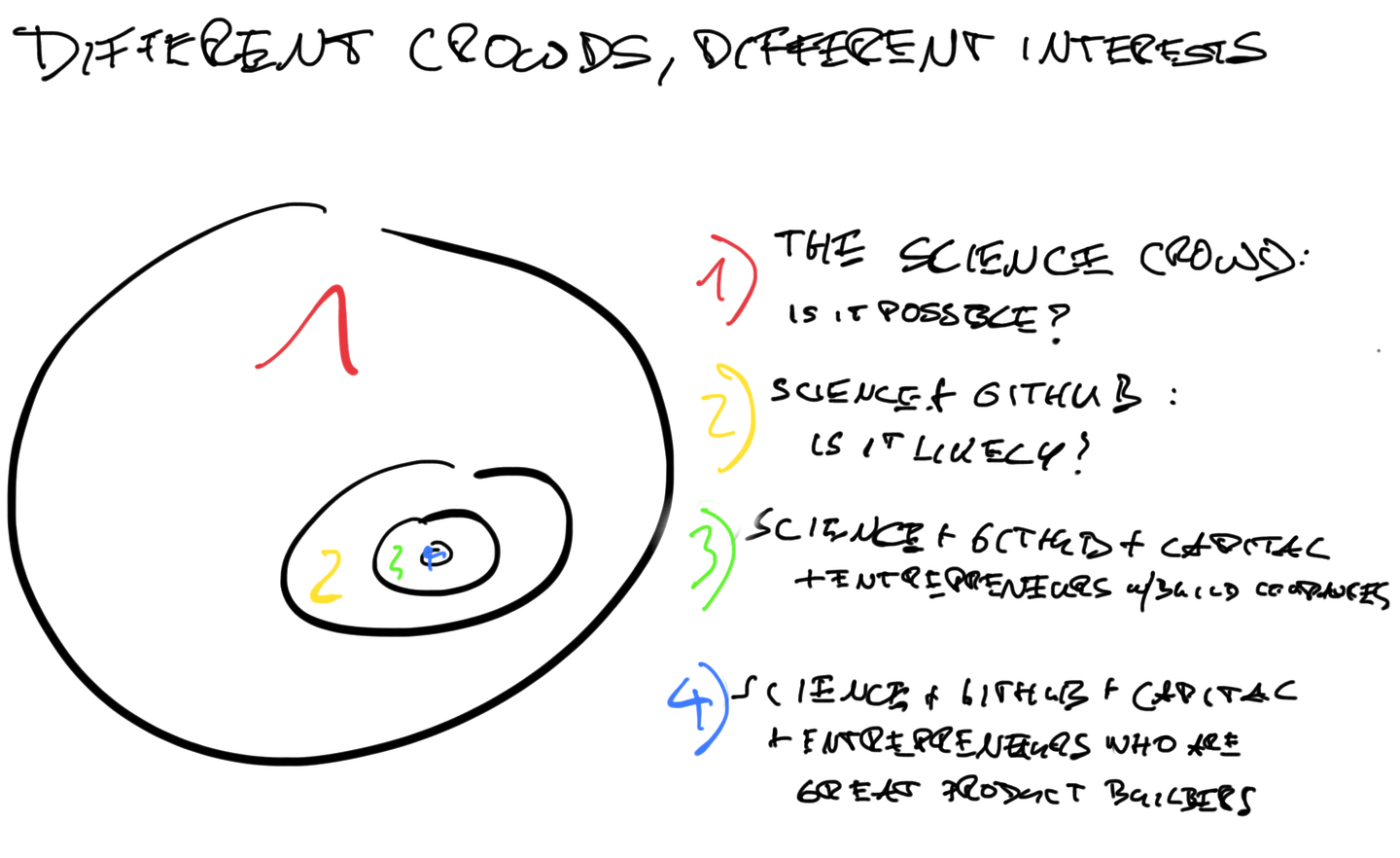

On the startup side in the summer of ’16, I had stalked on the internet a series of popular and active arXive folks from all kinds of AI verticals, for a couple of weeks. I also attended some AI conferences. The aim was to get a feel for the conversations, what interests them and what excites them.

This crowd is huge & exploding. There’s many indicators for this such as the # of AI-related papers on arXive or the Tensorflow/Keras activity. This crowd, above all, gets excited about science and what is possible.

I quickly learnt, though, that outside of image recognition the applied arXive crowd which tends to get excited about engineering (eg think arXive crowd that does GitHub stuff in small organisations) looked already much, much smaller.

Breaking things down even further the applied crowd that does entrepreneurship (think founders + capital + product-market-fit) looked fairly small.

My feeling was that, contrary to general opinion, that the competition in conversational AI among startups was low and that there would be enough space for Rasa to build towards.

What happened

There’s certainly some AI verticals (eg payment fraud) where the competition is high. However, over time I learnt not to trust VC competition slides in AI at all. Instead I ask founders about data sets instead and learn more from the data side on what companies in the space are competing on and how intense the fight is.

Most of the industry and public debate in AI, however, continues to be around what is possible and to some extent likely. Different crowds have different interests and ‘my crowd’ continues to be very, very small.

This has many reasons. For one, platforms don’t deal well in addressing startup problems.

The arXive/Tensorflow crowd rules in platforms. It rarely gets non-coders and their (business and data) involved. There’s relatively little by the platforms built by for dev teams, too.

They don’t easily solve for problems that enable developers build stuff such as what Rasa developer Souvik documented last week, for example.

Important conferences such as NIPS are dominated by platform attendees, too. Platforms assume specific data sets. There’s a lot of talk about models, algos — much less about data, data engineering.There’s a lot of excitement about what’s possible. There’s a lot justification for this excitement in visual imagery, but much less so in other AI verticals imo. Much of what is happening (and concerns me) reminds me of middle age scholasticism. People are deciding what would happen based on reading books ( — >papers on arXive) rather than looking at nature (— > data sets & data engineering problems).

Closer to my home, this is how the mobile industry was for a long time. Before the App Store, the mobile industry was full of future vision slides of what is possible, eventually, only if then. Ben Evans loves tweeting these about those 2004 mobile industry slide artifacts. Survivors from early startups (such as the Openwave Mafia) and early investors such as Accel’s Rich Wong dreamed of Open Mobile for a long time before it happened.

Conversational AI is a different beast than mobile, but in my opinion the general premise that there is not much action in conversational AI is still true. This leaves a lot of opportunity for Rasa and others. In Alan’s words:

“Over the last few years, deep learning has delivered major breakthroughs in image recognition, and with our deep learning approach to dialogue we’re aiming for similar results in conversational AI. With this seed funding, we’re able to invest more into applied research and bring these advances to our rapidly growing open source community.”

4 Great product/hard science teams where the founders are involved in product win

Perception

People in the community, from the start, very much liked this Alex and Alan as a founder team. In Jens Lapinski’s words:

“I first met Alex in 2014 at a pitch event of SDW where I was a ‘judge’. I really didn’t like what they are doing. But I liked Alex. Alex made is a point to talk to me every three months or so and gave me an update. In 2015, we launched Techstars Berlin and they applied for the program. When I met both Alex and Alan together for the first time, it elevated the team to a much higher level of interest. At Techstars we were looking for team, team, team before anything else. Specifically what I was looking for was raw intelligence, very strong coherence in the team, and a complimentary skill that can deliver functionally what they set out to deliver. They had all three in spades. So we invested. I think none of the people present on selection day were enamoured with the product.”

What I thought

Through working hands-on with the team for a couple of months I knew that this is growing to be an outstanding and fast product/hard science team. Intuitively I wanted to see if there was a large intersection where both worked together. Alex & Alan did that and their related learning curve was spectacular.

I am happy to take many risks when I invest pre-launch, but the team with hard science/product chops part is the key element which I need to de-risk before. Founder teams where one of the founders can’t contribute to product and is not passionate about it has become a massive red flag for me. While this may seem like I refer to the case of the non-technical founder, I actually am much more concerned about founder teams of scientists and AI researchers not spending enough time on product together.

We went through multiple iterations, pivots before we ran into challenges that led to Rasa and that the team was excited about and could build an authentic mission around.

Alan, back in ’12 while he was doing his physics degree at Cambridge, had pushed throwing neural nets at some of the problems his team had encountered. Neural nets or software around weren’t a “thing” there. His was an outlier solution view. Now, of course, there’s 1000s of kids across many disciplines who see neural nets as default solution path to try. Alan had seen the space and tools evolve over years, before him and Alex came together to build & shipped Rasa NLU.

What happened

Rasa NLU just hit its 0.12.1, and is no longer “me, too”. I’ve seen 250 teams since the end of ’15 in the wider AI space. Alex and Alan are still a top 3% team.

The combination of fast product/hard science teams is very rare. I see multiple outstanding teams (at A or B round) who have done, to my best knowledge, really well on the science side. However, on the product side all they could show is as much as a what I consider a prototype and very few product processes. There’s also a large different group of teams which has some product, some traction, but hardly any science. It’s very hard to add a common product/science ground as a company grows.